A Process For Hunting Multi-Baggers

Michael Mauboussin's 2023 ROIC-TSR Study In Support Of The Identification Step Of the SmallCap Discovery Cycle

My First article

Wow, welcome to my first article on the public internet. Thank you for taking your time. I have been mulling over the ideas in this article for maybe 6 months now and I write it as a means to crystallize my thinking on it. I will appreciate your constructive feedback on my writing. Let’s dive in…

Introduction

Presumably, most investors (as opposed to traders) hope to identify what Peter Lynch termed multi-baggers: stock investments that return multiples of the initial purchase price. Many anecdotes, studies, books, and equity screening tools are out there to filter the universe of investable equities. This article links Paul Andreola’s intuitive, repeatable process that is said to have identified several multi-baggers early on over the years with a study of Michael Mauboussin and Dan Callahan on how companies’ Return on Invested Capital (ROIC) and relative changes over time drive Total Shareholder Return (TSR).

To those who have limited time, the TLDR:

The study indicates that the process latches onto a beneficial ROIC-TSR situation for equities: the transition to profitability. Therefore, the process should identify a fertile hunting ground for promising equities with multi-bagger potential.

The Building Blocks

ROIC-Dependent 3-year TSR study

The 2023 study “ROIC and the Investment Process” by Mauboussin and Callahan US covers Russel 3000 companies between 1990 and 2022. While it covers many other aspects, I focus in this article on Exhibit 9 (see below). Here, the study sorts the companies into quintiles, i.e. into 5 different sets, each containing 20% of the companies based on their ROICs at the beginning and the end of rolling 3-year periods and tracks the companies over the 3-year periods. That allows tracking companies in terms of ROIC and TSR and their assignmed to the quintiles. Not surprisingly, companies beform best (highest TSR) when they improve ROIC over time, perform well when they have stable ROIC, and have a low TSR when they move to lower ROIC quintiles.

The Small-Cap Discoveries Process

Paul Andreola’s process postulates that small equities that perform well undergo a so-called discovery cycle. I chose the process as it makes intuitive sense to me as a capital-constrained retail investor, and Paul’s website small-cap discoveries claims to have identified several multi-baggers over the years:

We've brought our subscribers TEN 10-baggers over the last five years using our proprietary discovery process

Source: https://smallcapdiscoveries.com/

Very short, the discovery cycle consists of 5 phases:

In the pre-discovery phase, a small company is not widely known, is under-followed, and is too small for institutions to invest in.

A catalyst happens. Paul Andreola looks for companies that have high (25%+) sales growth year-on-year, and that are exhibiting their second consecutive profitable quarter - with minimal shareholder dilution.

Once profitable, retail investors and small-cap investors can get in, discuss, and share the company. The word spreads, and market capitalization grows.

As the company becomes bigger, institutional money can follow.

Fully discovered, potentially excessive market valuation. Time to get out?

For reference: I recently came across Atmos Invest’s discussion of Paul Andreola’s process. I have nothing to add.

For further reference, MicroCapClub founder Ian Cassel described in his blog post “Lightning in a bottle” similar characteristics to look for when aspiring to identify potential multi-baggers early:

Micro/Small Market Cap

High Organic Growth and/or Operating Leverage

A small outstanding share count

The Fertile Hunting ground: ROIC Quintile Transitions, … And Other Aspects Of The Discovery Process

Identifying The Transition To Profitability

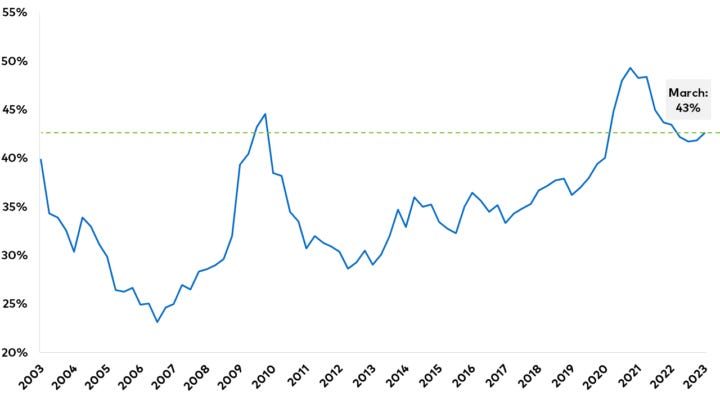

Consider that Mauboussin’s study indicates that companies that are able to transition from the second ROIC quintile to the quintiles 3-5 result in attractive 3-year TSRs (of course, if companies are in the worst quintile and they manage to transition to the higher quintiles, TSRs are even higher). I note from various sources that over time 30-50% of public companies are typically loss-making (see figure below), i.e. they constitute a big part of the lower two ROIC quintiles. As process triggers on a company that posts two consecutive quarters of profits, it identifies a company that is

still loss-making for the Trailing Twelve Months (TTM) in case the preceding two quarters outweigh the most recent two profitable quarters. In this case, I would think it is likely positioned towards the top of the second quintile, ready to move on up into a higher quintile in the future.

or just turning profitable, and will (hopefully) transition to the higher quintiles in the future.

In either case, the process picks up on the transition phase among quintiles - which is a fertile hunting ground with attractive TSRs.

While the above figure focuses on the Russell 2000 and Mauboussin and Callahan’s study on the Russell 3000 (this isn’t a scientific paper), the general thrust of my discussion is clear: some 30-50% of companies are unprofitable at certain points in time and thus probably falls into the ROIC quintiles 1 and 2.

In summary, I believe that the small-cap discovery process phase 2 selects a fertile multi-bagger hunting ground.

25%+ Sales Growth

The process seeks companies with 25%+ YoY sales growth. I am unsure about this aspect of high sales growth as a prerequisite for multi-baggers - considering that e.g. John Neff, Peter Lynch, and John Huber were/are skeptical of companies that grow too fast - see Base Hit Investing’s recent article below.

That said, this rate of high growth can motivate investors to enter fast- and hyper-growth companies and pay a premium.

Company Size And Institutions As Positive Contributors

I am unsure of the impact of company size on TSR. However, it appears reasonable to expect an additional positive contribution to the TSR if institutional investors can only invest when a grows to a certain size. I would expect that the same happens once a company is included in bigger stock market indices so that passive funds invest automatically in the equity: When funds flow into a stock and the stock price moves accordingly, this should create a positive price (and consequently TSR) momentum.

Update January 01, 2024: A reader kindly shared with me the blog entry of Chris Mayer, author of the book “100 Baggers”. He states that if he wrote the book today, he would relax the size limits:

Size plays into the mix. But I’d be less dogmatic about it. Yes, you should prefer smaller companies, but the more important factor is to focus on the rate at which the business compounds its capital.

Source: Woodlock House, 2022.

Clearly, larger companies can become a multi-bagger by compounding earnings (as advocated by Chris Mayer). They can also transition among ROIC quintiles with the effects on TSR identified by Mauboussin and Calahan. However, larger companies have already been discovered, are followed by investment analysts, and institutions have already been able to invest. Hence, they do not benefit from an additional discovery boost and its associated funds (but market multiples can of course still expand to support the speed of multi-bagging). Smaller, undiscovered companies should, if they execute, multi-bag faster than their larger peers due to the discovery phases.

Conclusion

The study by Mauboussin and Callahan convinces me that Paul Andreola’s process identifies a fertile population of companies that have high TSR potential: companies that are on the verge of transitioning into higher ROIC quintiles. Moreover, while I am unsure about their individual contribution, I would expect the other aspects to contribute positively:

investors often pay up for fast sales growth companies

once at a certain size, institutional funds create further momentum, and inclusion in higher stock market indices should help here, too

minimal dilution (though not discussed here) and high insider ownership probably also contribute positively to TSR due to the scarcity of supply of shares as argued by Ian Cassel in his “Lightning in a bottle” post.

Taken together, these may additionally boost TSR. I would not be surprised if a further study on the ROIC quintiles’ constituents found that the companies identified in the process are at the higher end of the quintiles’ TSRs. A factor analysis of the different process aspects (transition to profitability, size, fast sales growth, presence/entering of institutional investors) might show their individual contributions to the TSRs.

Thank you for your time reading my first article. Feedback is very welcome. I wish you all a nice year-end holiday.