Acorn Energy: What Becomes Of the Brokenhearted?

The share price dropped by 40% after weak hardware sales disappointed overly optimistic investors. Was this overdone?

Disclaimer: I own shares of Acorn Energy, Inc., and stand to benefit if they rise in price. I may decide to purchase or sell shares at any time without prior notice. Do your own research and size positions appropriately if you invest. Nothing here is meant to be understood as investment or financial advice. AI tools assist my research and writing process, enhancing analytical efficiency and clarity.

TL;DR

A 40% post-earnings collapse raises the question: Is the Acorn Energy growth story broken? The income statement was hit hard by a drop in hardware revenue. But a look at the cash flow statement and the accelerating, high-margin SaaS business tells a different story. This report analyzes whether the thesis is broken or just the stock price.

Passion and love, they have a way

Of slipping into blackness, uncared for of slipping away

The deck is cut, the cards turned, the hand is played

And all we ever hope for burns to ashes and drifts away

Now don’t let our love slip into this darkness

Source: Bruce Springsteen, The Brokenhearted

Introduction

My initial write-up, just a day before the uplisting to NASDAQ, proved well-timed. Shares soared from $18.55 to a high of $33, to hover in the mid-to high $20s. Yesterday, the company reported Q3 numbers, and, there is no other way to put it, shares cratered by 40% to a close of $14.20.

For context, my prior (and initial) article about Acorn Energy was

Let’s see if the 40% share price drop post Q3 earnings was overdone.

The Heart of the Matter

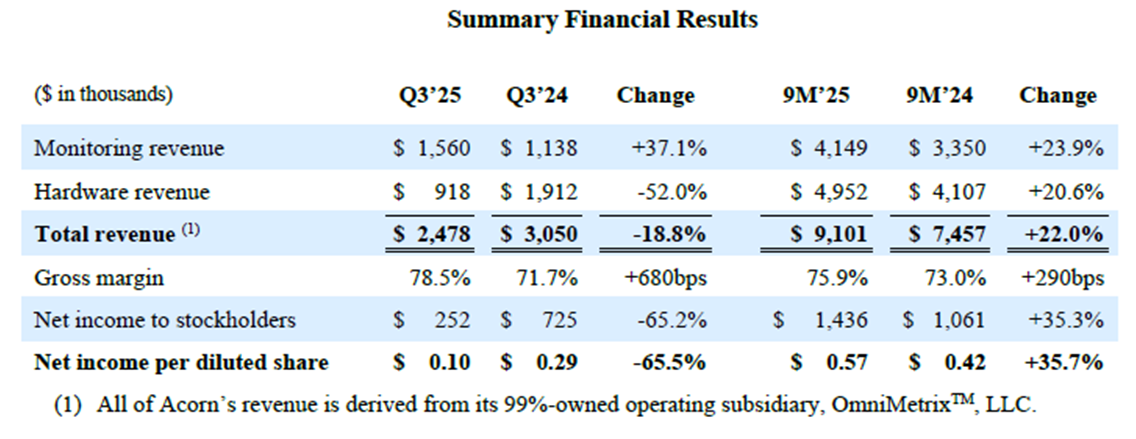

The market’s reaction was swift and brutal, but it was not without reason. The Q3 income statement reveals a contrast between the company’s two sources of revenue. The completion of the large telecom contract created a significant hardware revenue hole, while the recurring monitoring business showed impressive strength.

The market’s reaction was swift and brutal — but perhaps not entirely rational. Under the surface, Acorn’s cash generation and recurring revenues tell a different story. The critical question for investors now is: has the thesis been broken, or has the stock simply been brokenhearted?