Elixir Energy: Unlocking Deeply Buried Value in a Supermajor's Playground

With its new focused strategy, a proven blueprint from its neighbor, and a supermajor partnership in the making, Elixir's resource value is becoming impossible to ignore.

Disclaimer: I own shares of Elixir Energy Limited and stand to benefit if they rise in price. I may decide to purchase or sell shares at any time without prior notice. Do your own research and size positions appropriately if you invest. Nothing here is meant to be understood as investment or financial advice. AI tools assist my research and writing process, enhancing analytical efficiency and clarity.

TL;DR

I believe Elixir Energy is working its way to a major re-rating, driven by three developments the market is overlooking.

A “Free” Catalyst: The Diona-1 well is drilling this quarter, fully funded by a partner, providing a high-impact, no-cost shot on goal, and potentially even near-term high-margin revenues, allowing the company to pursue its strategic plan towards production.

A Blueprint: Neighbor Omega Oil & Gas' recent success has validated parts of the geology and commerciality of its play. A direct read across may not be advised, but it is an encouraging sign as both companies’ materials show the same formations.

Supermajors’ Playground: The pending ADNOC takeover of partner Santos creates a motivated buyer in the basin. This, combined with Shell's ongoing investment next door, validates the region's strategic importance and creates multiple potential paths to monetization for Elixir's vast resource base.

Introduction

For much of the past year, Elixir Energy (EXR.AX) has been a story of unrealized potential. However, a series of seismic shifts, a strategic overhaul, a neighbor's breakthrough success, and a multi-billion dollar corporate deal on its doorstep, the narrative. Elixir is no longer a speculative bet on geology alone; it is now a focused company with an analogue, a path to production, and a strategic partner. This article will break down these three key pillars of the new, and I believe de-risked, investment case.

To avoid confusion, the “$”-sign represents AUD in this article. I use “USD” to denote US Dollars when needed. This article provides an overview of the interesting developments and progress since April, when I published my last report:

Annual Report

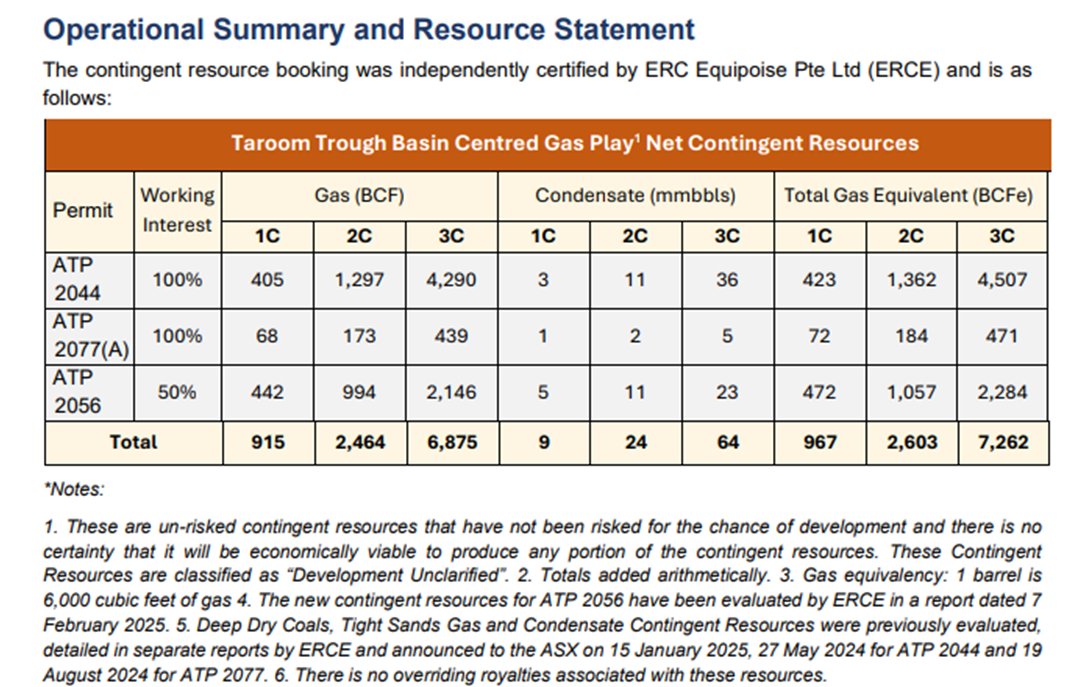

The company published its annual report for the year ending June 30, 2025, on August 29th. The company’s officially booked contingent resources are:

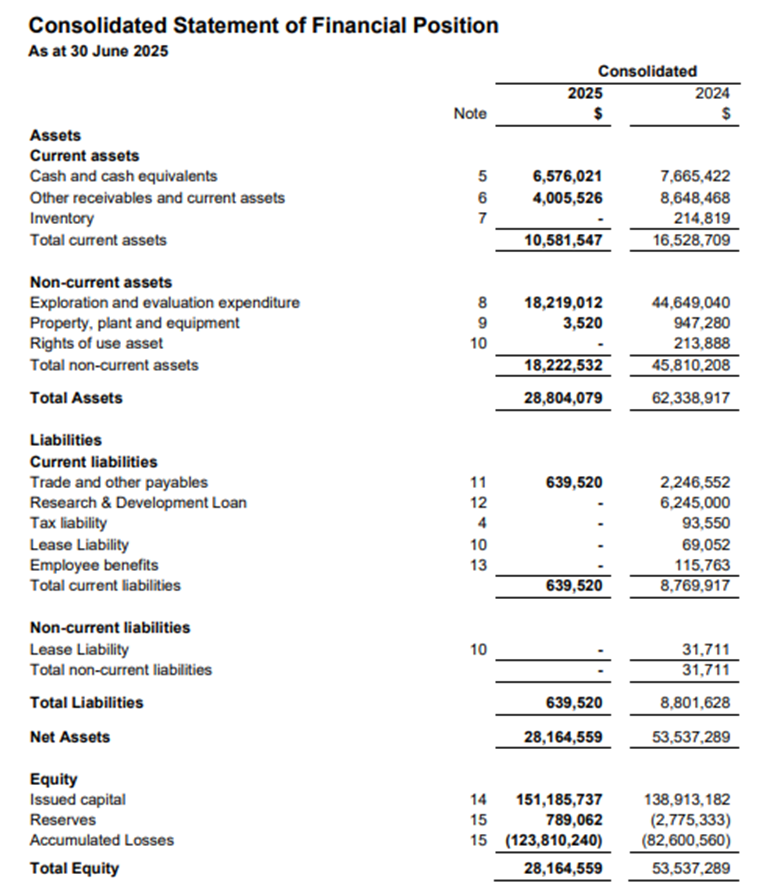

The Balance Sheet shows a $26M decline in exploration assets following the deconsolidation of its Mongolian assets as part of the new strategic plan (see below). As of June 30, the company had $6.6M in cash and $4M in receivables (mostly the R&D incentive receivable). These current assets provide a strong cushion against the $0.64M in current liabilities.