EMERGE Commerce: From Broken Roll-Up to Disciplined Operator

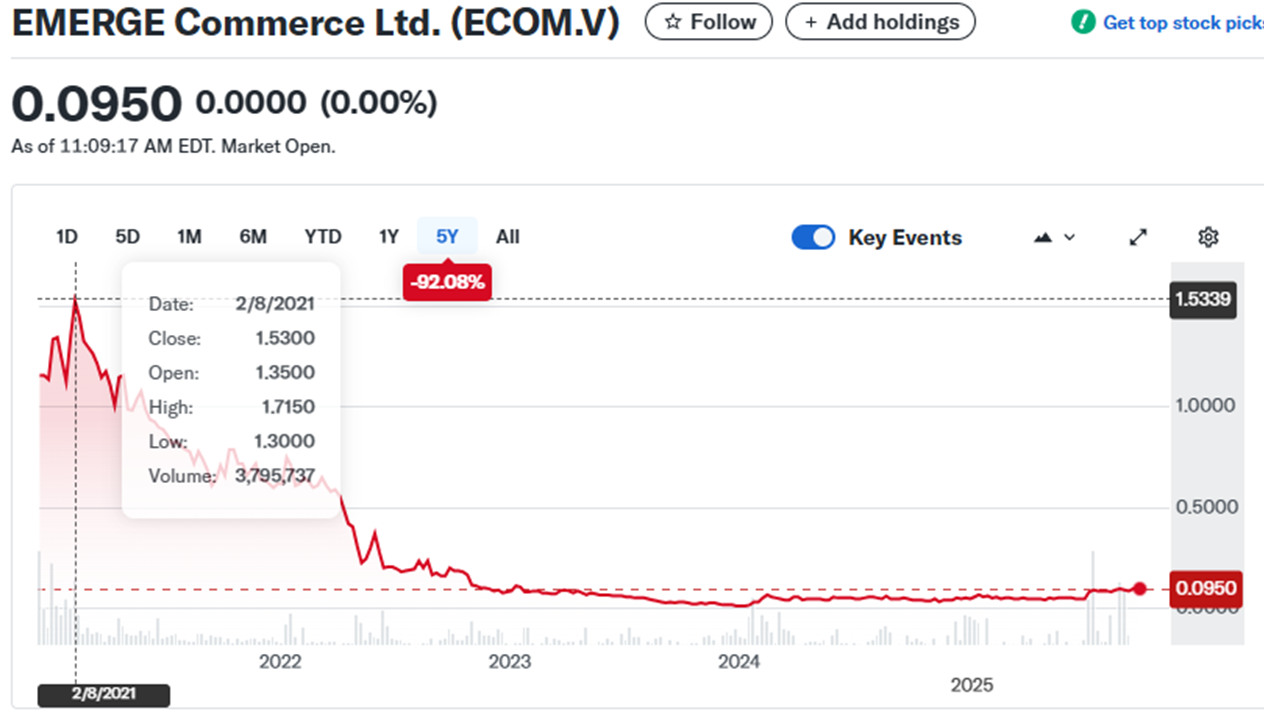

After a 90% Collapse, Has This Nano-Cap Finally Found a Sustainable Path to Value Creation?

Disclaimer: I own shares of EMERGE Commerce Ltd and stand to benefit if they rise in price. I may decide to purchase or sell shares at any time without prior notice. Do your own research and size positions appropriately if you invest. Nothing here is meant to be understood as investment or financial advice. AI tools assist my research and writing process, enhancing analytical efficiency and clarity.

TL;DR

The Story: After a failed, debt-fueled roll-up strategy ("ECOM 1.0") led to a ~90% share price collapse, EMERGE Commerce (ECOM) has executed a successful operational and financial turnaround, stabilizing the business ("ECOM 2.0") and now aspires to launch towards profitable growth ("ECOM 3.0").

The Strategy: The company now focuses on two resilient, counter-seasonal niches—grocery (truLOCAL) and golf—with a disciplined, cash-flow-centric approach.

The Proof: The recent Tee 2 Green (T2G) acquisition was accretive in its first quarter under EMERGE; company filings show the cash generated exceeded the $1.1M cash paid at close.

The Financials: The balance sheet is significantly de-risked (net debt down ~80%), and the company has swung to positive earnings and cash flow.

The Valuation: Trading at ~0.5x run-rate revenue, the market appears to be pricing in the company's troubled past. A short-term rerating for a profitable e-commerce company to 1x or 2x revenues would double or quadruple the shares from today. This aligns with my very conservative earnings power model, and even when modeling a significant slowdown in the second half of the year, the analysis suggests the share price has limited downside, with considerable upside if the company successfully executes its growth strategy. For the longer-term horizon, a higher valuation seems possible IF the company executes.

The Risks: Key risks include the need for continued execution, tight liquidity (Current Ratio < 1.0), and the inherent challenges of a nano-cap stock with low trading volume.

Introduction

This article is a follow-up analysis of EMERGE Commerce (TSX.V: ECOM) of the first 8th Wonder Airlock protocol. The first quick scan supported a deeper follow-up. Will this nano-cap company of approximately ~$15m fully diluted Market Capitalization (more on the FD share count below), with thin trading volume (320K avg volume), hold up to additional scrutiny, or falter?

The post-pandemic era has served as a crucible for the e-commerce sector. Many companies that experienced parabolic growth during lockdowns now face a challenging environment characterized by high customer acquisition costs, normalizing consumer demand, and heightened competition. Against this backdrop, stories of operational discipline and strategic realignment are particularly noteworthy.

ECOM presents a case study of such a transformation. After an ambitious but ultimately flawed attempt to build a diversified portfolio of e-commerce brands—a strategy that led to a burdened balance sheet and a lack of synergies—the company was forced into a period of critical restructuring.

While its shares have approximately doubled since the start of 2025, it is still down more than 90% since its high of about $1.50 during the days of the pandemic:

Today, a "new" EMERGE has surfaced, one defined by a disciplined operational model, a laser focus on the resilient niches of grocery and golf, and a significantly de-risked financial profile. The recent acquisition and rapid value extraction from Tee 2 Green (T2G) serves as a tangible proof-of-concept for this refined strategy, suggesting a repeatable playbook for future growth. This analysis will delve into the operational and financial turnaround of the company, examining the lessons learned from its past, the strength of its current verticals, and its capital allocation strategy. The central question is whether the company's successful pivot has created a fundamentally sound and undervalued investment opportunity, or if the market's current valuation appropriately reflects the risks that remain.

Unless stated otherwise, the “$”-sign will denote CAD.

The Company

Materials Used

Interviews

Q2’25 Results

2025 Management Information Circular

History, Strategic Change, and Lessons Learned

To understand Emerge Commerce today, one must first appreciate its evolution through three distinct strategic phases. The company's journey from a high-risk aggregator to a disciplined operator provides crucial context for its current financial health and go-forward strategy.

ECOM 1.0: The Diversified Roll-Up

Initially, Emerge pursued an ambitious strategy to become the "Constellation Software of e-commerce." The thesis was to acquire a wide array of disparate, niche online brands and operate them under a single corporate umbrella. However, this model, successful in the software industry, proved ill-suited for the hands-on, brand-centric nature of consumer e-commerce. The acquired businesses lacked operational synergies, and unlike software assets, they could not be left on autopilot; they required constant community-building and marketing investment.

The "Perfect Storm" and a Forced Pivot

The vulnerabilities of the ECOM 1.0 model were exposed by a "perfect storm" of macroeconomic headwinds. The company had funded its acquisitions at the peak of the pandemic-driven e-commerce boom, often utilizing variable-rate debt, which was cheap back then. As consumer spending patterns normalized and central banks began aggressively raising interest rates, the company was caught with declining organic growth and rapidly escalating debt-servicing costs. With its net debt peaking at approximately $32 million, the business model became unsustainable, necessitating a fundamental strategic shift to ensure survival.

ECOM 2.0 & 3.0: The Era of Focus and Disciplined Growth

This crisis forced management to initiate a comprehensive turnaround plan focused on simplification and financial discipline. This "era of focus" involved a series of critical actions:

Divestitures: Non-core assets were sold to streamline the portfolio. For example, the company sold several registered domains to Shopify for $536k in January.

Deleveraging: Proceeds and operating cash flow were used to aggressively delever, reducing total net debt by nearly 80% to its current level of under $5m.

Strategic Concentration: The company refocused exclusively on its two strongest verticals, grocery and golf, which management describes as the company's "original DNA."

Having stabilized the business, ECOM has now entered its current phase, "ECOM 3.0." This era aspires to be a disciplined, cash-flow-centric approach. The key lesson learned was that synergy is paramount. The new playbook is built on acquiring profitable, "old school cash flow businesses" only within its core verticals, where the company can apply its digital marketing expertise to unlock immediate, high-ROI growth, as demonstrated by the recent T2G acquisition. This strategy now forms the foundation of the company's path forward.

Management & Board

A corporate turnaround is as much a test of leadership and governance as it is of strategy. Emerge Commerce's ability to navigate its financial distress and execute a strategic pivot can be largely attributed to an experienced management team and a board with a significant vested interest in the company's long-term success.

Founder-Led