[Quick Freebie] Greggs Plc

Taking A Bite: Net Cash, 20% ROCE, ~100% Reinvestment Rate, And PE Multiple Below Median

Introduction

Hello, this is a rather quick and superficial post, and hence free. For context, you can read up on Greggs Plc ($GRG.L) e.g.

here:Yesterday, Greggs posted a trading update that the market did not like - see the post by

Brief Thesis

This post is quick and free, hence not too many details, but I reason as follows:

They are in a net cash position (year end: GBP 125M), growing both in terms of LFL sales as well as in number of stores (each year up, even during COVID), and have a profitable history. Greggs is guiding to continue opening new stores next year. So they don’t seem to fall of a cliff.

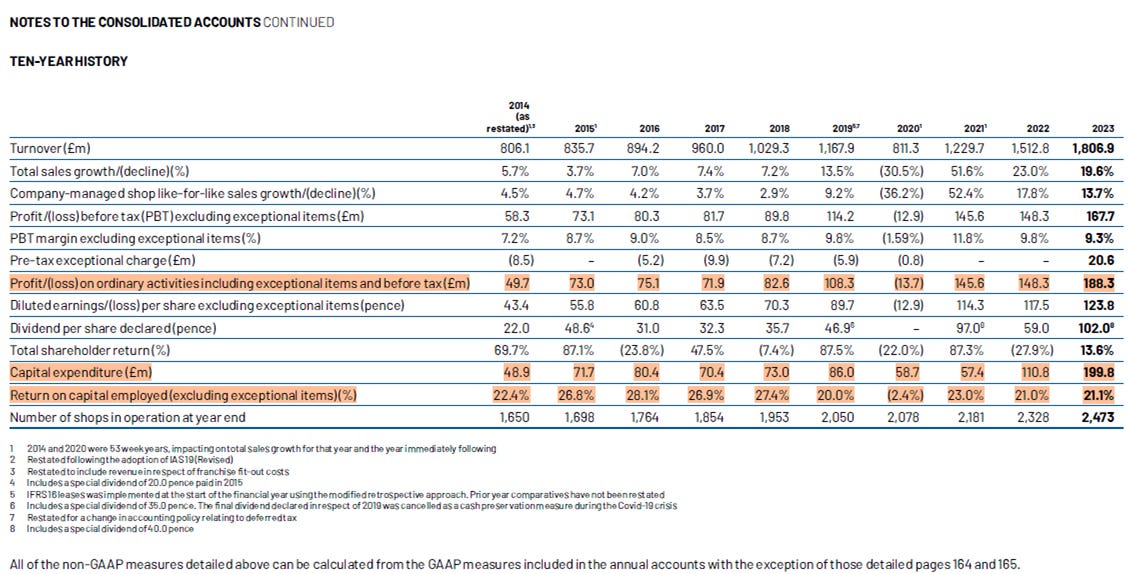

looking at the 2023 Annual Report we see a very nice long term ROCE track record (excluding exceptional items) and a high reinvestment rate. The reinvestment rate varies between ~100%+ (e.g. in 2016 and 2023) and 75% (in 2022). The ROCE came down a bit, but usually seems to be in excess of 20%.

Dilution is modest and there is a Employee Benefit Trust (see my recent Wickes post) that I interpret as a vehicle to repurchase shares and hold it in a trust structure (instead of the Balance Sheet treasury). The number of shares issued by the trust in 2022 and 2023 was below 1 million, i.e. below 1% of dilution on the total number of shares on issue.

In addition we see a flexible dividend policy - I think they should not pay a dividend when / if they can reinvest at ROCEs in excess of 20%, but maybe the opportunities vary each year.

Quick Valuation Thoughts

Compounding

A quick consideration for the value compounding effect is:

[(1 + reinvestment rate x ROCE) x dilution factor]^runway x change in market multiple

The annual return is then:

{ [(1 + reinvestment rate x ROCE) x dilution factor]^runway x change in market multiple} ^ (1/runway) + dividend yield - 1

Bear Case

This case assumes that the company runs out of growth runway, dilution increases to 5%, 100% of profits are reinvested but without generating returns. During a 5 year investment horizon the market multiple contracts to 10 (currently it is 16.9) and the dividend is canceled:

{ [(1 + 0%) x 95%]^5 x 10/16.9} ^0.2 + 0% - 1 = -14.5 %

Downside in 5 years: -54%

Conservative

Assuming 80% reinvestment, 20% ROCE, 1% dilution, a static market multiple (despite Gurufocus showing me that in the past the median PE multiple was 23% higher) during a 5 year investment horizon with a dividend yield of of 2%:

{ [(1 + 80% x 20%) x 99%]^5 x 1} ^0.2 + 2% - 1 = 23.5%

Upside in 5 years: +187%

Optimistic

Assuming 100% reinvestment, 22% ROCE, 1% dilution, the PE multiple reverts back to its median PE of 20.8 from the current 16.9 during a 5 year investment horizon with and a canceled dividend:

{ [(1 + 100% x 22%) x 99%]^5 x 20.8/16.9} ^0.2 + 0% - 1 = 25.9%

Upside in 5 years: +216%

Conclusion

Unless the UK consumer falls complete off a cliff I believe Greggs will do fine. They have the ingredients of a compounding machine (which they did in the past): profitable, net cash, high reinvestment rate, 20% ROCE,… In fact they should cut the dividend and seek more ways to invest at these rates.

The base case is 3x the upside of the downside in what I consider a draconian bear case scenario (note that I probably would assume that data would show a slow down and allow investors to cut losses). Consequently I started a position.

Disclaimer

I own shares of Greggs Plc and stand to benefit if they rise in price. I may decide to purchase or sell shares at any time without prior notice. Do your own research and size positions appropriately if you invest. Nothing here is meant to be understood as investment or financial advice.