SenSen Networks: A Deeper Dive Into the Sixth Straight Quarter of Positive Cash Flow

An analysis of the Q1 FY26 results, which reveal a strengthening balance sheet and key contract wins that signal growing momentum.

Disclaimer: I own shares of SenSen Networks Limited and stand to benefit if they rise in price. I may decide to purchase or sell shares at any time without prior notice. Do your own research and size positions appropriately if you invest. Nothing here is meant to be understood as investment or financial advice. AI tools assist my research and writing process, enhancing analytical efficiency and clarity.

TL;DR

SenSen Networks has reported its sixth consecutive quarter of positive operating cash flow and record receipts in Q1 FY26. The company’s balance sheet has materially strengthened, shifting from net debt a year ago to net cash today. While performance is encouraging, continued monitoring is warranted as non-cash factors and contract timing influence short-term cash results.

Introduction

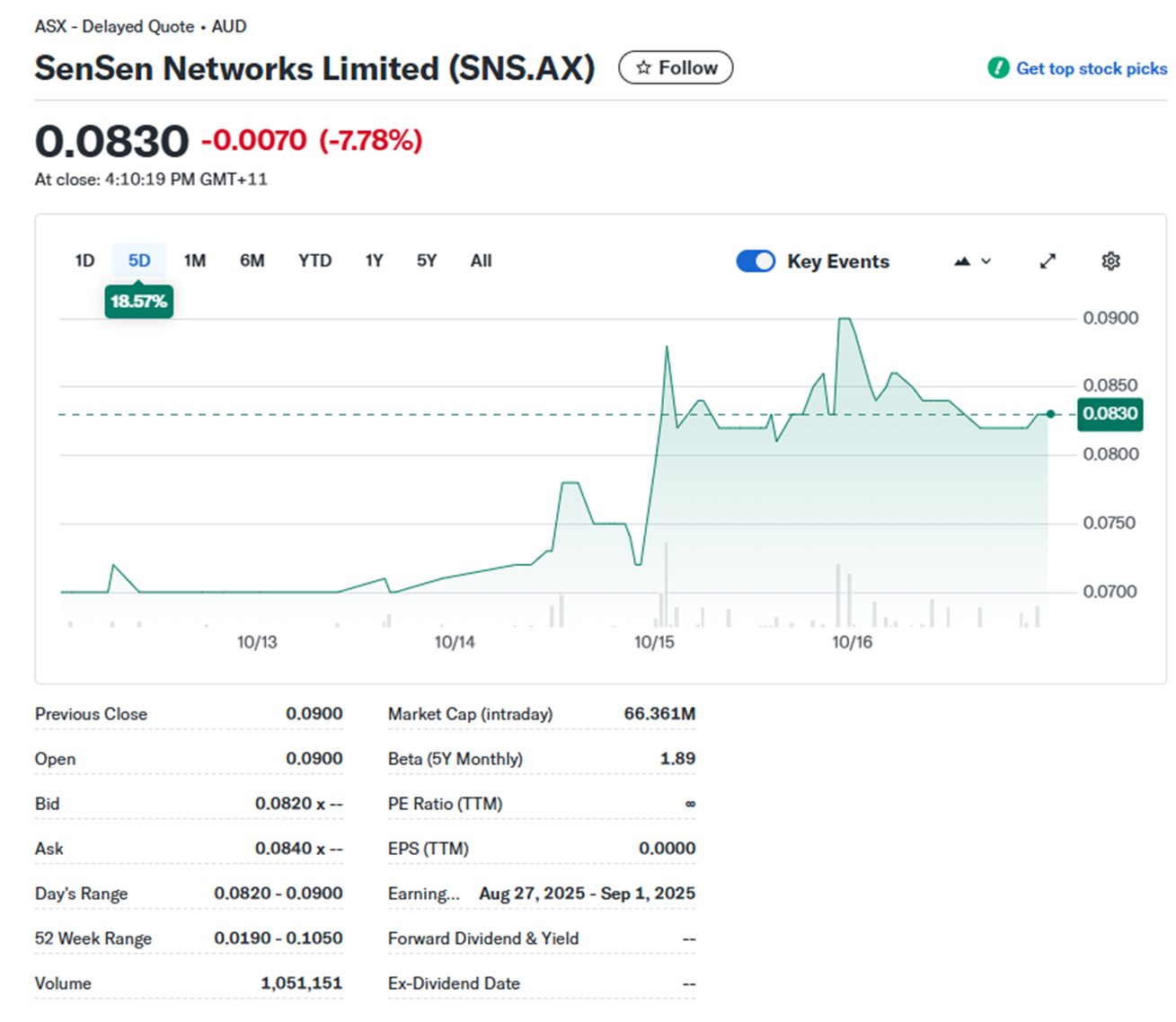

SenSen Networks (ASX:SNS) released its Q1 FY26 activities report on October 15, 2025, and the results have been well-received. The report highlights a sixth consecutive quarter of positive operating cash flow, record customer receipts, and a series of new contract wins. These achievements suggest that the company is successfully executing its growth strategy. In this brief article, I will delve into some of the financial report’s details to provide an overview of SenSen’s performance, including a year-over-year comparison of its operating cash flows, an examination of its improved debt position, and a look at the key factors driving its recent success.

For reference, my recent article was:

For clarity: “$” denotes Australian Dollars (AUD).