[EDITED] Flow Traders - The Market Will Fluctuate

Twin-engine of investment returns, benefactor from volatility, megatrends as tailwinds,... and a EUR 6 billion puzzle?

EDITED February 20, 2025. For traceability additions are marked in bold, with square brackets [] and the word EDIT. Deletions are marked with strikethrough text.

To better understand and high-light the risks of market-making in general and with respect to ETPs in particular, I added a reference to my chat with Perplexity.AI leveraging the R1 model.

It seems I confused in memory the role of Melvin Capital during the GME craze - they were a hedge fund caught in a short squeeze, not a market maker. Apologies for that - “It Ain’t What You Don’t Know That Gets You Into Trouble. It’s What You Know for Sure That Just Ain’t So”

While being a risk, I added that short squeezes and market crashes can also be opportunities of widening bid-ask spreads.

By coincidence I came across a Bloomberg interview with the Flow Traders CEO and took the opportunity to add it.

I′m goin' deeper underground

There′s too much panic in this town

I'm goin' deeper underground

There′s too much panic in this town

Source: Deeper Underground, Jamiroquai

Introduction

According to this source, the statement within this post's title is accredited to John D. Rockefeller or J.P. Morgan. In addition, the world of investing is full of other quotes and wise words regarding how volatility is a friend of the informed (and steadfast) investor. The main thrust of this article is that Flow Traders' earnings should benefit during volatile markets and help me stomach those times. While volatility is different from risk, the market crash during March 2020 certainly felt to many market participants not quite like a gift.

This post is free for the most part because I mostly leverage free sources of information and add only a limited amount of my own brainpower - in select (and I hope value-additive) parts. In the paywalled part of this post, I attempt to match the company’s balance sheet with the Gurufocus and Koyfin numbers for total debt and net debt to solve the mystery of a EUR 6.3B enterprise value discrepancy (and consequently a difference of reported EV-based multiples). Spoiler alert: both seem to neglect significant balance sheet positions for these calculations; as I am no trained accountant I will refrain from calculating a precise enterprise value.

I believe you can very well get by without the premium part of this post if you read the free part of this post and watch Sharp Investing’s YouTube videos, the latest of which just came out to get a good view of the company, and its latest results. However, if you like to see my attempt at matching accounting entries to solve the EUR 6.3B puzzle, a brief statistical analysis of ROE and shareholder equity, and my arguments why Flow Traders presents a compelling (albeit not entirely risk-free) opportunity I would be very glad to welcome you to the premium section, of course.

Outline

What Do They Do?

Strategy: Diversification & Reinvestment

Megatrends

Risks

Why Publish This Article Now?

I Promised A EUR 6 Billion Puzzle

Going Deeper (Underground): Why The EV Discrepancy?

Statistics Of ROE & Equity

Conclusion

Disclaimer

What Do They Do?

Flow Traders is a Netherlands-based liquidity provider - a role also called a market maker. Wikipedia gives a good summary of what that is. Note that Flow Traders deals only with Exchanged Traded Products (ETPs), not individual securities.

The income of a market maker is the difference between the bid price, the price at which the firm is willing to buy a stock, and the ask price, the price at which the firm is willing to sell it. It is known as the market-maker spread, or bid–ask spread. Supposing that equal amounts of buy and sell orders arrive and the price never changes, this is the amount that the market maker will gain on each round trip.

Source: Wikipedia on Market maker, accessed February 17, 2025.

In my understanding such companies

earn money from spreads

need to hedge risks associated with entering and holding such positions until they can sell the bought product (ideally they only hold products for a short time) and the trades are settled

provide liquidity in the market and through their trading they help price discovery and ultimately support a narrowing of the bid-ask spread

Market makers should benefit from times of increased trading activity with a lot of volatility (widening spreads) - typically a characteristic of market panics as these times should provide opportunities to earn high returns. The worst conditions are probably a flat, low volume trading in the markets - I imagine this applies to the phase of a benign positive market (i.e. no GameStop diamond hands FOMO environment) as well as the depressive phase after a major stock market crash when no one dares to enter the market (say after the great financial crisis). Consequently, I understand that market makers’ earnings should run (partially) counter to an economic recession with crashing stock, bond, or crypto prices which should provide a level of protection against broader market sell-offs. At least in theory, when the hedges and diversification strategy work... at least until the market bottoms and volumes subside.

The way I understand the business model, Flow Traders enters long and short positions for securities and has to mitigate risks through appropriate hedging. While waiting for trades to settle the fair values of the expected payables and receivables are recorded on the balance sheet. Updates to fair value judgments are recorded through the profit and loss statement. I quote from the financial report of the first half of 2024 (page 38, my high-lighting):

a. Financial assets and liabilities held for trading

The valuation of trading positions, both long and short positions, is determined by reference to last traded prices from identical instruments from the exchanges at the reporting date. Such financial assets and liabilities are classified as Level 1.

A substantial part of the financial assets and liabilities held for trading which are carried at fair value are based on theoretical prices which can differ from quoted market prices. The theoretical prices reflect price adjustments primarily caused by the fact that the Group continuously prices its financial assets and liabilities based on all available information. This includes prices for identical and near-identical positions, as well as the prices for securities underlying the Group’s positions, on other exchanges that are open after the exchange on which the financial asset or liability is primarily traded closes. The Group’s Risk and Operations departments checks the theoretical price independently. As part of their review, they monitor whether all price adjustments can be substantiated with market inputs. Consequently, such financial assets and liabilities are classified as Level 2.

For offsetting (delta neutral) positions, the Group uses mid-market prices to determine fair value.

b. Trading receivables and payables

Trading receivables and payables are measured on a fair value basis and designated at fair value though profit and loss. In accordance with the Group Accounting Policy of trade-date accounting for regular-way sale and purchase transactions, sales/purchase transactions awaiting settlement represent amounts receivable/payable for securities sold/purchased but not yet settled as at the reporting date. Receivables from and payables to broker-dealers, including cash balances held at the Group’s clearing firms and the net amount receivable or payable for securities transactions pending settlement are included in this category. The Group maintains portfolio financing facilities with its prime brokers to facilitate its trading activities to finance the purchase and settlement of financial instruments. These financial liabilities are included at amortized cost.

Gains, and losses, including on derecognition, interest expense and foreign exchange gains and losses are recognized in profit or loss.

All this is to say that an investment in Flow Traders requires trust in management’s judgment - not just in the operational aspects but also in the reporting. Hence, I understand that things can go south quickly even if the balance sheet looks fine - if the judgment is wrong and neither the risk department nor the Auditor (much later, after the fact) catches the error. This is something to get comfortable with and account for through position sizing. That said, the company records predominantly Level 2 (and to a lesser extent Level 1) fair values. It seems Level 3 is reserved for their direct investments e.g. in startups - which is only a small relative to the overall balance sheet size. This is good as Level 2 requires significantly less judgment than Level 3 (and Level 1) - and thus less can go wrong from that perspective.

Ultimately, it boils down to the company earning a suitable spread on trades using its trading capital while appropriately hedging risks. Flow Traders (page 46) explains trading capital as follows:

Financial assets held for trading relate to settled positions and are closely related to financial liabilities held for trading, trading receivables, trading payables, other assets held for trading and other liabilities held for trading. The sum of these positions is our net trading capital position at our prime brokers and together with cash used in the management report as trading capital.

Strategy: Diversification & Reinvestment

For years, Flow Traders has been investing in its systems and trading teams to diversify their business across geographies and asset classes. This is paying off for them as they benefit e.g. benefit now from the newly created Crypto ETFs. Also, it appears that lately, their earnings correlate less with the volatility index VIX than they did in years prior.

Last year the company announced a shift in their capital allocation strategy. Before last year the company distributed a large part of earnings to its shareholders but as they are highly capital efficient (while the numbers fluctuate depending on the market conditions they earn frequently more than 20% on shareholder equity) they now direct earnings to bolster their trading capital (which is close to the shareholder equity). This should boost compounding (at least until they reach a point at which the return on trading capital drops due to the capital base size).

Traditionally they had no or only little debt, but now seem to be comfortable to take on debt if they see opportunities to trade. I welcome this as they have demonstrated that they can profitably trade (rarely a quarterly loss). I follow the argument made in Sharp Investing’s latest video that seemingly they pay ~8% on debt and earn 20%+ profits on capital... but I will keep watching their debt levels as it might increase fragility1.

[EDIT: I came across an interview of CEO Mike Kuehnel with Bloomberg on opportunitites, recent financial results, and reinvestment to grow trading capital.]

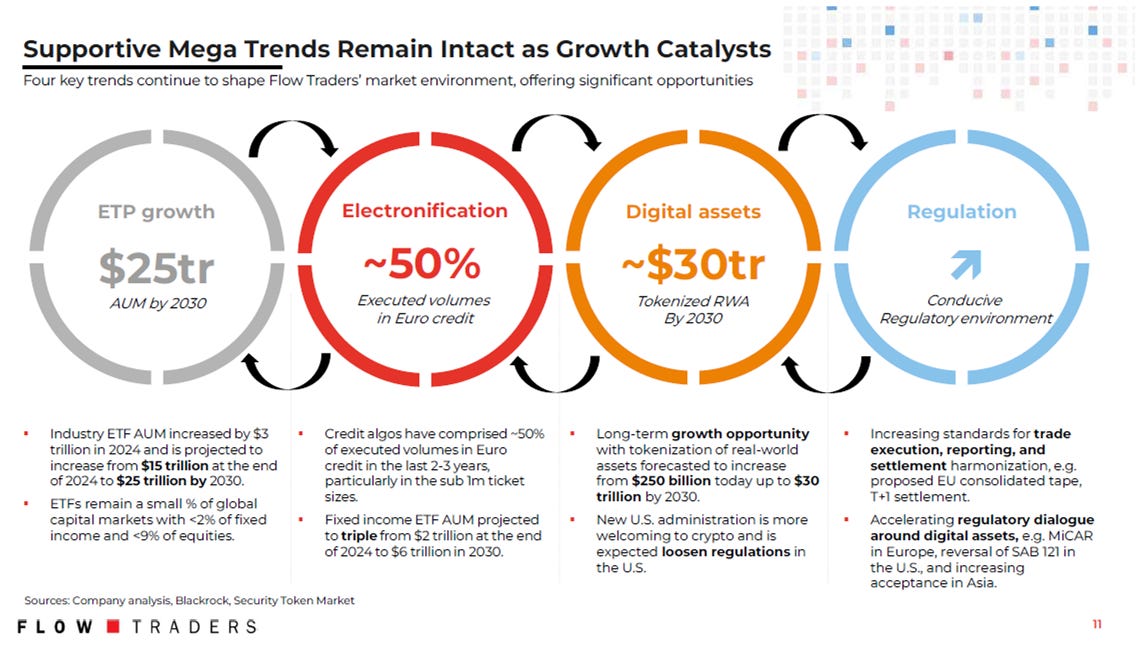

Megatrends

Flow Traders benefits from several large trends.

Electronic trade increases globally, where there is fast trading, there is a market for liquidity providers.

Passive Investing Vehicles (ETFs) - which I am cautious about, but as long as volumes are traded (up or down) Flow Traders should keep on earning.

More and more products (and financial innovations) become available - while I am cautious about financial innovations such as Crypto itself, I think this is a way for me to benefit from booms and busts without some of the risks.

Risks

I have no way of knowing or seeing that their hedges work. Considering that they currently have limited leverage this is probably fine, but there is a risk of a blow-up. While this company superficially resembles what Long-Term Capital Management (LTCM) did in the 1990s (following spectacular gains the company blew up - see “When Genius Failed” by Roger Lowenstein), I believe the fact that the company has existed since 2004 and in the past years they virtually never posted a quarterly loss (although returns fluctuate depending on the market conditions) I believe they are conservative enough to not recklessly risk the business. They appear to me as methodically building their capabilities and only now started taking on leverage - and that so far was only slow to be taken on. Hence, I think this is not LTCM.

The company enters long and short positions for the securities it trades. As we saw during the GameStop short squeeze equity market maker [EDIT: short selling hedge fund] Melvin Capital went under due to “the Reddit crowd” (…"apes", "diamond hands", remember “Roaring Kitty”?). However, I understand that the company deals with ETPs and not in individual securities and thus believe that the associated risk of a short squeeze is therefore smaller (but beware, I base this on a handwaving assumption of mine).

I also mentioned the risk of a misjudgment regarding fair value estimates and while I believe that the fact that most fair value estimates are of Level 1 or Level 2 nature and thus less prone to erroneous adjustments mitigates the risk somewhat.

The company reporting looks more complicated than for simpler & traditional businesses due to the hedging, the trading capital, etc. There is a real chance that I misunderstand or miss something (hint: Dunning-Kruger effect).

[EDIT: Be sure to check my chat with Perplexity.AI regarding the role and the risks of market-making in general and for ETPs in particularme.]

Why Publish This Article Now?

After jumping last week, the company currently trades for about EUR 1.1B - 1.2B market capitalization but I believe there is a reasonable runway for compounding shareholder equity. For example, see Sharp Investing’s valuation (around 17:30). I consider last week’s results early proof that their model of diversification and capital compounding works. In addition, I am a bit cautious of the current market environment. For example,

’s interviews (e.g. this) with argue that debt refinancing in the private sector in the latter part of 2025 could drain liquidity and cause a contraction in equity markets. Also, the recent interview with indicates potential trouble for the US housing sector while other housing publications predict something to the contrary. I also note that the correlation between bitcoin (as a proxy for crypto, apologies if this is a lazy substitute on my part) and the technology stocks of Nasdaq-100 has been erratic but increasing:On the one hand, the correlation between bitcoin and tech stocks is erratic. At the same time, we see that the periods of high correlation are getting longer and are only interrupted by shorter periods of low correlation. This argues against using bitcoin as a stand-alone diversification element within a portfolio," concludes Giesen. Bitcoin and the other crypto assets that are highly correlated with it are therefore unsuitable as a systematic hedge that performs differently from technology stocks. "Bitcoin can be classified as a speculative technology stock rather than an asset class in its own right," says Giesen.

Considering the above observations, I hold a position in Flow Traders (thus I am biased and I stand to benefit when the shares rise in price - this is not investment advice, take responsibility and do your own work, I may buy and sell without telling anyone… the usual) with the thesis that the company

has proven a track record of profitability in a variety of market regimes,

seems to exhibit increasing profitability and operating leverage,

has a diversification strategy that reduces its earnings correlation with the VIX providing stability,

should be able to compound intrinsic value through reinvesting its earnings and additionally juice the returns by adding leverage (at responsible levels),

could serve as a hedge in a market correction / economic contraction phase,

[EDIT: while market-making means entering long and short positions which can pose risks, short squeezes and market crashes represent also opportunities due to widening bid-ask spreads,]

benefits from megatrends, and

should benefit from a market multiple re-rating considering that it’s WACC is currently at 5.38% according to gurufocus.com

Michael Mauboussin 2014 paper “What Does a Price-Earnings Multiple Mean?” states that the steady-state P/E multiple should equal

1/(cost of equity):With a WACC of ~5.4% - which is dominated by the cost of equity due to the low leverage of Flow Traders - a steady state multiple P/E of 18.5 (not the current ~7x) follows. Note, this is only the steady-state part, i.e. before assigning any value to future profitable growth. In other words before any consideration of mega-trends and before any reinvestments with returns above the cost of capital.

I believe the above explains also why I see the Flow Traders as having a twin-engine of investment returns operating in my favor: intrinsic value compounding through reinvestment of profits (and leverage) and potential for significant multiple expansion.

I Promised A EUR 6 Billion Puzzle

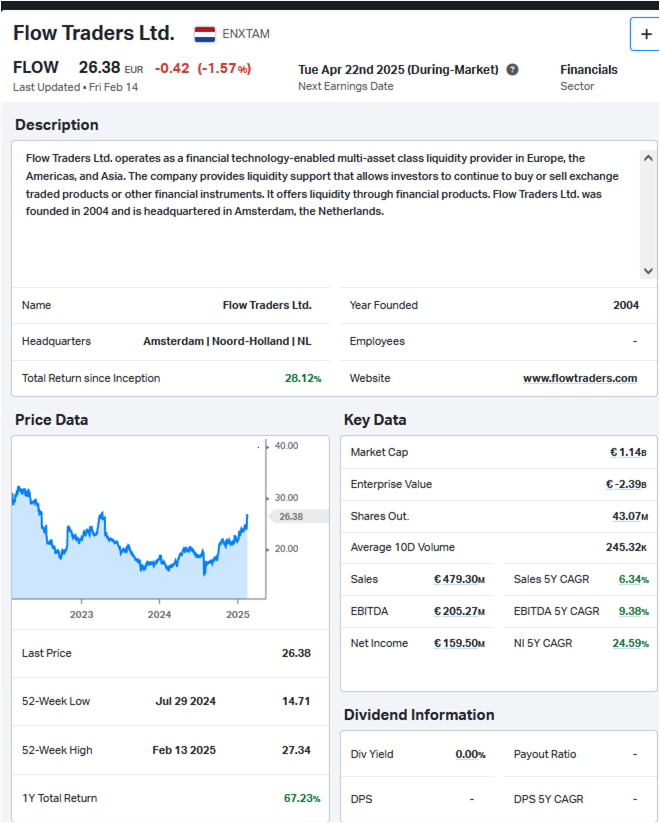

When looking at Flow Traders I notice that automated screeners diverge in terms of the Enterprise Value (EV) calculation (i.e. market price + net debt). The following observations make me want to check and adjust the calculations as needed (in the premium section below):

Gurufocus shows an EV of EUR 3.9B (i.e. ~ EUR 2.7B of net debt)

TIKR Terminal and Koyfin show an EV of EUR -2.4B (i.e. 3.2B of net cash):

I believe Sharp Investing’s valuation in the video above makes a pretty good case that I largely agree with - and it is probably all you need. However, I wanted to provide my thoughts on the valuation given that the company seems to confuse these widely used screening websites (or rather their data providers) and tackle the EUR 6.3B difference between EUR -2.39 and EUR +3.94… Note that what triggered this article is the company’s trading update - the full audited results and balance sheet have not been published, yet. I currently expect them to behave like last year when they published their trading results in early February and the full-year audited report followed in March. Therefore, sites like Koyfin, TIKR, and Gurufocus (and myself below) work off the the latest available audited balance sheet available in Flow Traders’ Results Centre: 1H 2024.

Going Deeper (Underground): Why The EV Discrepancy?

In this section I try to match the Q2 2024 entries to understand the screeners’ confusion. Koyfin and TIKR show the company has total debt of EUR 2,785.73M and net debt of EUR -3,522.49M at the end of the second quarter of 2024. Gurufocus reports the company ended Q2 with a market capitalization of EUR 798M and an Enterprise value of EUR 3,577M - implying a net debt position of EUR 2.78B. With a month-end price of EUR 18.48 per share for June 2024 and a total debt per share of EUR 64.48, Gurufocus uses a total debt of EUR 2,785.79M - i.e. virtually identical to Koyfin.