[Freebie] Pantheon Resources Plc: An Options Approach

Why I think the market price underestimates the chances of success.

“What do you call a stock that’s down 90%? A stock that was down 80% and then got cut in half.”

David Einhorn, according to Analyzing Alpha (accessed March 18’25)

My corollary: What do you call a stock that’s quadrupled? A stock that doubled, doubled again. (See figure below.)

Trigger Warning

This company is a junior oil and gas explorer focused on Alaskan assets listed on the UK AIM exchange.

Its assets will involve fracture stimulation.

The company saw quite some allegations from shorters publicly (look at the chart below and guess when). It was a noteworthy experience to see two prominent energy pundits (both have ~100K followers on X, both run investment vehicles, one was “seen on CNBC, Bloomberg & in WSJ, Forbes and Barron’s”) join that discussion on the short side - and engage in what I consider an unethical behavior: doxing.1

By all means - I am a generalist and biased investor who has been holding shares since 2021 and saw the allegations and experienced dramatic drawdowns - so maybe ignore this post, go with public talking heads that claimed some wild things about the company. After adding shares during the last year with every positive announcement, I am up significantly with my position. So yes, color me biased. I enjoy my (brief?) victory lap.

Introduction

This free post will not go into all the depths of geology and the history of the company. Instead, I will point you to resources with which you can do your own due diligence. My post draws on the company's independent resource reports and communicated plans, the public support by government and state officials, and try to estimate what odds the market provides to the company realizing the potential value in what I consider a conservative base case. I will also list some of the potential catalysts that I am aware of.

This post has a different format than my usual posts as it is not yet a revenue-producing company. Hence, the approach I take is inspired by a coin toss:

Tails: if the company were not able to get the necessary funding (it seems some $100M-$300M are needed - but the company appears conservative with such kind of forecasts, so the needed amount might be lower) it cannot build out the assets to get to cash flow self-sufficiency. In that case, depending on how optimistic or pessimistic you are, the company is a 0 or, alternatively, the value of the capitalized exploration costs.

Heads: if it can attract funding to get to cash flow self sufficiency, the resource valuation is realized some time into the future (and discounted back today).

Based on the payoffs I estimate for these events, the current market capitalization represents the relative odds provided by the supposedly efficient market.

I will reason on why my payout estimates are likely conservative and the market has the odds wrong. All the calculations are of course ballpark estimates. I just need to be roughly correct. Feel free to adjust the calculations to your estimates.

Outline

TL;DR

Resources For Your Research

Balance Sheet as of June ‘24

Resource Estimates

Estimating The Odds

Positive Signs

Potential Upside

Catalysts

Risks

Conclusion

TL;DR

From my calculations, Mr. Market prices the chances of Pantheon Resources plc succeeding at 10-30%. This is purely based on already booked resources and probably the odds represented by the market are lower than that (because the upside is probably higher).

The company is catalyst-rich and associated with a major (geo-)political change of wind direction. I see multiple positive signs and believe that

Resources For Your Research

Company Website: https://pantheonresources.com/index.php

Ticker: PANR.L (P3K on German exchanges, PTHRF for OTC)

Shares Outstanding ~ 1.2B, Market Capitalization (Yahoo Finance): GBP 790M (~$1.03B)

Flight’s Community Discord Server with much information regarding geology, Alaska LNG, … etc (highly recommended): https://discord.gg/PknYJ89E

Flight’s YouTube Channel, 8 great interviews (at time of writing): https://www.youtube.com/@TheFlightDeck-FIS

The company publishes webinars and e.g. AGMs via InvestorMeetCompany. There you can study older webinars and keep up to date regarding invitations to the next meetings as they are announced. InvestorMeetCompany also has a Youtube channel where the recordings are posted: https://www.youtube.com/@InvestorMeetCompany

Balance Sheet as of June ‘24

The half-year accounts of 2024 (UK-listed companies publish accounts semi-annually) show the following balance sheet:

For my less conservative downside case, I will use the shareholders’ equity (predominantly derived from $293M of capitalized exploration expenses) of $277M. Essentially, this is an argument that there is value to the intellectual property of data and exploration knowledge that someone else would need to expense to re-create an equivalent.

Resource Estimates & Timeline

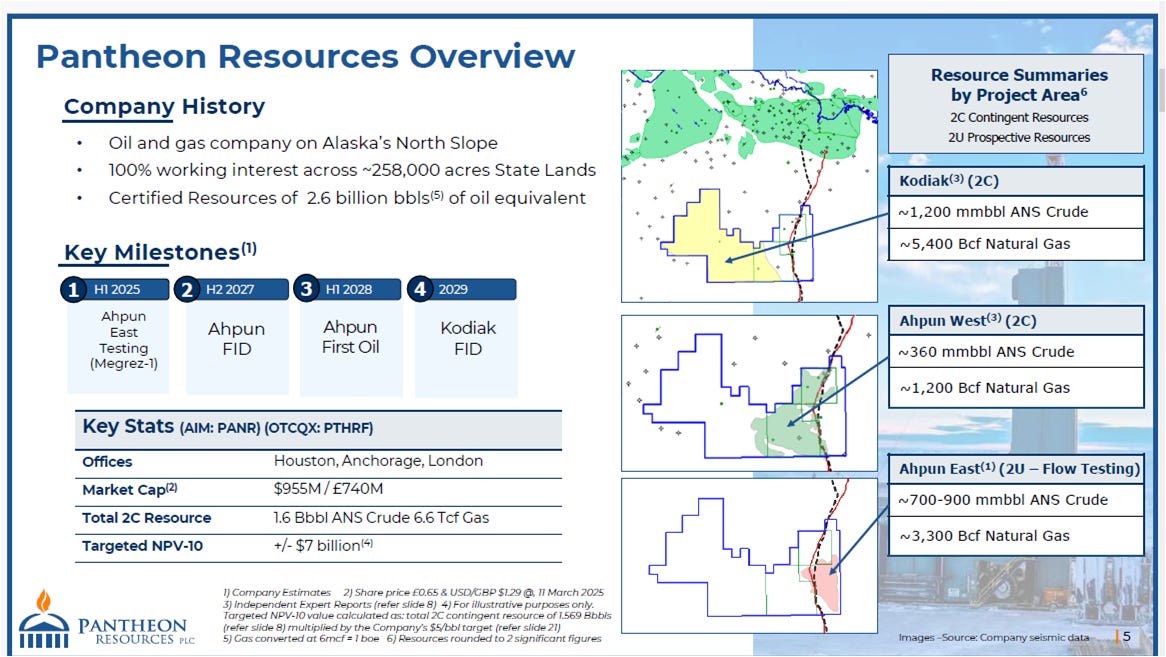

In the recent AGM linked above, the following was presented:

We see that 1.6B BOE has been certified by independent 3rd parties. In addition, 6.6 trillion cubic feet (TCF) of natural gas were converted to ~1B BOE with a conversion factor of 6 MCF = 1 BOE. Note that Alaska North Slope Crude prices are higher than the commonly quoted WTI - as far as I understand at least. Note also that Ahpun East is starting to undergo Flow Testing (the Megrez-1 well) and management estimates 700-900M BOE for that acreage (plus 3.3 TCF of natural gas).

A more detailed view:

Note that the Ahpun East (“Eastern Topsets”) estimate of liquids is lower than the previous slide (“609” vs “700-900)”) - this is explained by the fact that 609M BOE was the pre-drill estimate: based on what was encountered in the Megrez-1 well (but not yet flow-tested), management expectations were exceeded and 15-50% higher resource estimates may be in the cards.

Estimating The Odds

Heads - I win

The company plans for production in 2028 - I will take this as the time when the market attributes “full value”. So,… 3 years from now.

From the overview slide above, the company targets a PV-10 of $7B (i.e. a 7x to current’s market capitalization). Note, this does not even include the natural gas value according to footnote 4 on the first AGM slide above.

I will create two scenarios:

In a more optimistic scenario I assume that the company’s PV-10 is the present day valuation for the 2028 production target. Hence, I take PV-10 at face value in this scenario.

In a more conservative scenario I further discount the PV-10 at a draconian 26% per year (this gives a nice factor of 2 for these calculations): $3.5B of value in today’s terms.

Tails - I Lose

I will create two scenarios:

The downside is a total loss of capital.

As mentioned above, the is the shareholders’ equity of $277M.

Calculating The Odds

General

The current market capitalization (MC) is a sum of the weighted payoffs. As this is a bet with only two outcomes (essentially a coin toss), we can express the weighted sum as a function of only one variable. I denote:

x as probability of Heads, ph as the payoff of heads

1-x as probability of Tails, pt as the payoff of tails

Scenario 1: Pessimistic Downside & Discounted Upside

Scenario 2: Downside Limited By Equity & Discounted Upside

Scenario 3: Pessimistic Downside & Undiscounted Upside

Scenario 4: Optimistic Downside & Undiscounted Upside

Positive Signs

There are probably plenty of others, but:

On the day of his inauguration, President Trump issued an executive order explicitly mentioning the development of Alaska’s natural resources.

PANR signed a Gas Sales Precedent Agreement with Alaska LNG phase 1 (a pipeline to distribute gas within Alaska and ultimately also feed a LNG terminal) turning what was a liability (except for the fact that gas reinjection into the reservoir improves pressure and recovery of liquids) into a cash flow asset - this could mean $180M annually of gas sales via the pipeline, that _maybe_ the company can lend against.

The company’s natural gas is of very little CO2 content and thus does not require expensive pre-processing to strip excess CO2 in order to meet pipeline specifications (a big chunk of costs required for another phase of the Alaska LNG project is associated with a plant to strip other operators’ gas from CO2).

Alaska LNG phase 1 was mentioned e.g. in the press conference of the Japanese Prime Minister visiting the US. South Korea and other countries expressed interest in gas supply, too. US LNG imports by these nations would help balance their respective trade deficits. If they anyway import LNG, this may be an elegant solution to balance the trade and avoid (threatened) tariffs.

Very recently, the company managed to hire Max Easley as CEO. He is experienced in the operations of producing hydrocarbons at large companies. I take this as external validation by an industry veteran:

Potential Upside

Note that my upside estimate above was conservative. Hence, I think that the odds priced by the market are actually even worse than what I presented (if the upside is higher, the weight of the downside has to be increased to get to the current market capitalization):

From what I gather in the news, President Trump’s administration is looking at expediting the permitting processes for natural resources - especially in Alaska as expressed in the executive order. Note that currently, the company plans with the longest, i.e. worst-case, timelines (see above). Hence, the “value recognition” by the market might be closer than the above timeline shows and the present value consequently much higher. This can have an effect similar to the difference between the scenarios of “undiscounted upside” and those of “discounted upside“.

It did not attribute value to the best estimate of 6.6 TCF of natural gas (which can be converted to BOE by factor 6 MCF = 1BOE ). → 1.1B BOE.

It did not include Ahpun – Eastern Topsets pre-drill of Megrez (management estimate 609 million barrels (or more), and did not include another 3.3 TCF of natural gas.

The gas sales precedent agreement with Alaska LNG could (at some point) provide the company with ~$180M of annual cash flow.

While the resources quoted are estimates and there is a potential downside, there is of course also upside potential… It seems an industry proverb is that big fields get bigger (as you do more work to study and develop a prolific natural resource - be it hydrocarbons or minerals - you tend to find additional resources that you did not find in the beginning. It probably is more cash-flow and cost-efficient that way.

From past webinars I understand that the company uses conservative estimates for recovery factors and flow rates. Consequently, there may be upside from engineering advances, frack design, and maybe “simply” technological advances which we do not see in the certified resource estimates, yet.

The company has encountered Helium in its natural gas. Currently, it is unclear how much value can be attributed to that. If you assumed 1% of Helium concentration in the natural gas, the 9.9 TCF of natural gas would contain 99 BCF of helium. Valuing this $100 per MCF, another ~$10B of value is added. However, this would need to be discounted to account for the time value of money and the chances of actually unlocking this value (note I discounted it by 80% compared to what I could find a “run-off-the-mill" MCF of Helium goes for). Interesting aside: PANR’s chairman David Hobbs is also CEO of Proton Green, so maybe there are some future synergies.

Catalysts

The following are some of the events that could make the market shift the odds it implies in the pricing of the company:

Alaska LNG Project

Phase 1 progressing to FID.

News on international investors signing up to fund the project, or LNG import agreements by one or more nations.

Pantheon’s project timeline could be accelerated by shortening the EIS period. There were comments by President Trump’s administration to the effect of expediting permitting - this would pull forward the project start and hence the value realization.

Listing of Pantheon shares on a US exchange. This is being investigated, but no decision made yet.

Access to funding that is sufficient to build the initial production.

Near term: positive Megrez-1 well flow test results (steady news flow expected between now and the summer).

Risks

The following could slow or even derail the project.

Accidents or incidents along the way of developing the resources

The EIS fails for some reason.

President Trump’s administration changes opinions, or legal action by e.g. activists stopping/slowing project progress.

Despite tariff threats and negotiations, no investors want to fund the LNG project (despite which still) and no country wants to import Alaskan LNG.

In addition, the company might not be able to access financial markets.

The Megrez-1 well results do not live up to (heightened?) expectations.

From some of the comments I see on the discord server, I suspect that FOMO might be starting (or is ongoing already?). While FOMO might push share prices higher, it may also plant the seeds for disillusionment, disappointment, and shorters’ messaging to spread FUD (fear, uncertainty, doubt).

Conclusion

From the calculations presented above it appears that the market prices the company for a 10-30% chance of the company being able to attract funding and progress to cash flow generation. I think that the odds expressed by the market are even lower because I did not include any of the potential upside prospects in the calculations. And not to forget that I used a very high discount rate in the high-odds case. I just cannot help but think that the real odds are better than 30% given that:

The company has already a sizable resource estimate.

I see signs of support by politics and industry to push ahead with Alaska LNG phase 1 - which would benefit Pantheon Resources. It also supports local energy security within the state (instead of requiring the state to import LNG).

Political support in general for natural resource development since President Trump’s inauguration. There were messages regarding expediting permitting.

An industry veteran would not have signed up to lead a speculative high-risk junior explorer, I think.

The company recently refinanced convertible debt with more favorable terms - if perceived as ultra-risky, the terms would have gotten worse, not better.

Even if it was communicated that the company would not want to dilute shareholders, at current prices the company could raise capital via a placement - at current prices only 30-40% of additional shares would need to be placed to have adequate resources to get to cash flow self-sufficiency from field development. This would be painful and against prior messaging and probably would invite some shorters again. I assume this is an option of last resort but to unlock the full valuation of its resources it might be viable. As my calculations are based on market capitalization, not per share price, the odds would not be impacted by a share placement.

Ultimately, I think the value of the company is somewhere between 0 (the absolute downside) and the absolute upside $20B+ (1.6B BOE of certified resource + 900M BOE from Ahpun Eastern Topsets and 6.6 TCF of certified resource + 3.3 TCF from Ahpun Eastern Topsets = 4.15B BOE at $5/BOE + Helium). So, 20-30x of value compared to the current market capitalization at some future point - this of course needs to be discounted for the time value of money and your perception of the execution risk…

Bonus Scenario 5: What I Think

Discounting cash flows 7 years into the future at 10% means halving the present value. I speculate that Megrez-1 will be a success and that gas can be sold (i.e. the pipline is built). Not accounting for potential BOE pricing upside (i.e. valuing recoverable BOE in the ground at higher prices than $5), finding more resources, or valuing Helium, with a downside risk of 0, I place $20B by 2032, i.e. $10B at present value.

As laid out above, I think the chances of accessing funding sufficient to progress to a cash-flow positive stage will be better than 10%.

As a cross-check consider also this: at the end of the Q&A session of the AGM presentation, chairman David Hobbs expressed the ambition to get production to 300k BOE per day (at some point in the future). Assuming a $40 PBT margin2 and a tax rate of 25% (I just pull these out of thin air to make a point) we get to $9M net income per day, i.e. $3.3B annually. Adding only the Alaskan gas sales of $180M that are associated with the gas (i.e. negligible additional cost, $135M post tax) we are $3.4B. Put whatever your favorite earnings multiple is on this and discount to the present. With a 5x earnings multiple (despite decades-long supply of resource in an advantageous location, this is still oil and gas and maybe cyclical), a 10% discount rate, and 7 years to reach market recognition, we get to a ballpark PV10 estimate of $17B.

Do your own research, and reach your own conclusions. This is nonetheless risky (if I am wrong) and might be volatile even if I am right.

Disclaimer

I own shares of Pantheon Resources plc and stand to benefit if they rise in price. I may decide to purchase or sell shares at any time without prior notice. Do your own research and size positions appropriately if you invest. Nothing here is meant to be understood as investment or financial advice.

One of the two published pictures of a passport and supposedly an IP address and a location of access when posting in favor of Pantheon. Even if I think the published information was (at least partly) incorrect because the supposed IP address was certainly not a valid IP address, but who cares? He believed it was valid information and believed apparently that it is ok to publish personal documents.

In the recent AGM it was made clear that economic considerations for production prices can only be established after flow tests and proper analysis. In the past, the company communicated quite low break-even prices in the $30 range. With ANS crude trading at a premium to WTI, Pantheon has an extra cushion. At time of writing, it seems WTI is trading at $68. Of course, if you have a pessimistic view on “through-the-cylce” oil prices, Pantheon’s breakeven price, or the production numbers, adjust the calculation.

The old conversion / valuation rule of thumb of gas to BOE (6 MCF gas =1 BOE) was based on calorific values and at one point presumably comparative values. 6 MCF gas may generate say $6 (in fact PANR proposing supplying the pipe line at maximum price of $1/MCF) against some $70 / bbl for ANS crude. Using BOE this way greatly overvalues the gas .

Thanks Tom. Indeed the precedence agreement values the gas up to a certain volume that way. For anything in excess of that I think it is up for negotiation.

The base scenarios 1-4 don't use the gas volumes though.